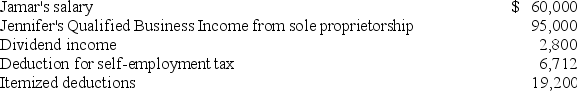

Jennifer and Jamar are married and live in a home with their 13-year-old dependent son,Oscar.This year,they had the following tax information.  Compute adjusted gross income (AGI) and taxable income.

Compute adjusted gross income (AGI) and taxable income.

Definitions:

Memory

The cognitive process involving the encoding, storing, and retrieving of information over time.

Encoding

The method of transforming data into a format that can be retained in memory storage.

Storage

The retention of information or material in memory for future retrieval.

Retrieval

The process of getting information out of memory storage and into conscious awareness.

Q5: Gosling,Inc.,a calendar year,accrual basis corporation,reported $756,000 net

Q6: Mrs.Hepp completed her 2018 Form 1040 on

Q18: Mr.Forest,a single taxpayer,recognized a $252,000 loss on

Q24: A taxpayer who wants a jury trial

Q35: An individual taxpayer is not required to

Q40: Joanna has a 35% marginal tax rate

Q72: Wages paid by an employer to an

Q94: Twenty years ago,Mr.Wallace purchased a $250,000 insurance

Q96: In order to be considered a dependent,an

Q102: The interest earned on a state or