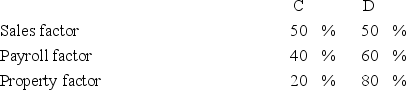

Albany,Inc.does business in states C and D.State C uses an apportionment formula that double-weights the sales factor; state D apportions income using an equally-weighted three-factor formula.Albany's before tax income is $3,000,000,and its sales,payroll,and property factors are as follows.  Calculate Albany's income taxable in each state.

Calculate Albany's income taxable in each state.

Definitions:

Environment

The surroundings or conditions in which a person, animal, or plant lives or operates, including both natural and human-made conditions.

Delinquent

A person, typically younger, who behaves in a way that is illegal or not acceptable to most people.

Verbal Abuse

The use of words to cause harm to the person being spoken to, including insults, threats, and attempts to control or demean.

Physical Abuse

The infliction of bodily harm upon another person through forceful actions, including hitting, beating, or burning.

Q4: Loretta is the sole shareholder of Country

Q5: Vandals destroyed a business asset owned by

Q22: An individual's taxable income equals adjusted gross

Q22: If a corporation with a 21% marginal

Q35: Bill contributed business realty ($375,000 FMV and

Q36: Alice Grim,a single taxpayer,has $719,000 taxable income,which

Q40: Ben received a $5,000 tuition scholarship from

Q53: Fifteen years ago,Lenny purchased an insurance policy

Q103: Qualified dividend income earned by individual taxpayers

Q106: Mr.Thano,age 47,withdrew $22,000 from his employer-sponsored qualified