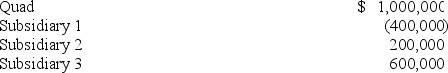

The Quad affiliated group consists of Quad,a Delaware corporation,and its three wholly-owned subsidiaries.This year,the four corporations report the following net income (loss) .  If Quad elects to file a consolidated U.S.tax return,compute consolidated taxable income assuming that subsidiaries 1 and 2 are domestic corporations and subsidiary 3 is a foreign corporation.

If Quad elects to file a consolidated U.S.tax return,compute consolidated taxable income assuming that subsidiaries 1 and 2 are domestic corporations and subsidiary 3 is a foreign corporation.

Definitions:

Corporation

A corporation is a legal entity that is separate from its owners, offering limited liability to its shareholders and having the ability to own property, sue, and be sued.

Professional Corporation

A business entity formed by lawyers, doctors, accountants, and other professionals, offering certain tax and legal advantages.

Sole Proprietorship

A type of business ownership where a single individual owns, manages, and is responsible for all aspects of the business.

Partnership

An association of two or more persons to carry on as co-owners a business for profit.

Q13: Section 482 of the Internal Revenue Code

Q18: Mr.Forest,a single taxpayer,recognized a $252,000 loss on

Q22: Sue,a single taxpayer,purchased a principal residence in

Q52: Which of the following items is included

Q53: Fifteen years ago,Lenny purchased an insurance policy

Q63: The FICA taxes authorized by the Federal

Q68: Bisou Inc.made a $48,200 contribution to charity

Q81: Ms.Knox,age 34 and single,has $127,800 AGI,$108,200 of

Q86: Mr.Lainson died this year on a date

Q88: In applying the basis limitation on the