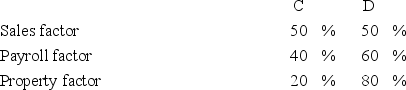

Albany,Inc.does business in states C and D.State D uses an apportionment formula that double-weights the sales factor; state C apportions income using an equally-weighted three-factor formula.Albany's before tax income is $3,000,000,and its sales,payroll,and property factors are as follows.  Calculate Albany's income taxable in each state.

Calculate Albany's income taxable in each state.

Definitions:

Adolescent Groups

Social collectives consisting of individuals in their teenage years, typically characterized by shared interests, activities, or developmental stages.

Crowd

A large number of individuals gathered together, often in a public place, possibly sharing a common interest or purpose.

Self-Esteem

The subjective evaluation or perception of one's own worth or value.

Intimacy In Friendship

Self-disclosure or the sharing of private thoughts.

Q10: Contributions to an employer-sponsored qualified retirement plan

Q14: Mr.Johnson borrowed money to buy Chicago municipal

Q25: A corporation can use the installment sale

Q29: Gwen and Travis organized a new business

Q35: The three Crosby children intend to form

Q51: Cash basis individuals must accrue market discount

Q53: Fifteen years ago,Lenny purchased an insurance policy

Q58: Tibco Inc.exchanged an equity interest in ABM

Q80: The substituted basis rule results in permanent

Q99: Lennie and Margo spent $2,800 for child