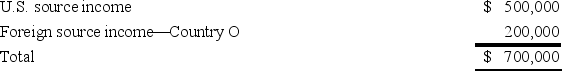

World Sales,Inc.,a U.S.multinational,had pretax U.S.source income and foreign source income as follows:  World Sales paid $50,000 income taxes to Country O.What is World Sale's U.S.tax liability if it deducts the foreign taxes paid?

World Sales paid $50,000 income taxes to Country O.What is World Sale's U.S.tax liability if it deducts the foreign taxes paid?

Definitions:

Lock-Up Option

A contractual agreement where shareholders are prohibited from selling their shares for a specified period following an initial public offering (IPO).

Tender Offer

A tender offer is a proposal made by an entity to the shareholders of another company to purchase some or all of their shares at a specified price for a limited time.

Business Judgment Rule

A legal principle that protects company directors and officers when making business decisions that are informed and made in good faith.

Co-Determination

A practice where workers have a role in management of a company, often through participation in management boards or committees.

Q24: A shareholder in an S corporation includes

Q27: A corporation is required to report differences

Q46: A controlled foreign corporation is a foreign

Q58: An individual must pay the greater of

Q59: A taxpayer that is using the installment

Q76: The sales factor in the UDITPA state

Q78: If a U.S.multinational corporation incurs start-up losses

Q92: The QBI deduction always has the impact

Q94: A corporation that owns more than $10

Q99: Lennie and Margo spent $2,800 for child