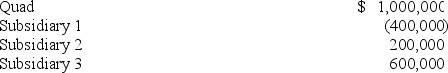

The Quad affiliated group consists of Quad,a Delaware corporation,and its three wholly-owned subsidiaries.This year,the four corporations report the following net income (loss) .  If Quad elects to file a consolidated U.S.tax return,compute consolidated taxable income assuming that subsidiaries 1 and 2 are domestic corporations and subsidiary 3 is a foreign corporation.

If Quad elects to file a consolidated U.S.tax return,compute consolidated taxable income assuming that subsidiaries 1 and 2 are domestic corporations and subsidiary 3 is a foreign corporation.

Definitions:

Process Cost Systems

Accounting methods used in industries where similar products are produced in a continuous process, allocating costs proportionally across all units produced.

Work In Process Account

An account that tracks the costs associated with the production process, including labor, materials, and overhead, for products that are not yet completed.

Machine Hours

A measure of the amount of time a machine is operated during a given period, used as a basis for allocating manufacturing overhead.

Overhead Rate

The ratio used to allocate indirect costs to products or services, based on a specific base such as labor hours or machine hours.

Q2: After 2017,a 1.4% excise tax applies to

Q7: A major advantage of an S corporation

Q10: Mr.and Mrs.Jelk file a joint return.They provide

Q16: A corporation is usually subject to tax

Q21: Ted and Alice divorced in 2014.Pursuant to

Q24: A corporation that is unable to meet

Q26: Sandy,Sue,and Shane plan to open Friends,an upscale

Q27: Reimbursed employment-related business expenses have no net

Q61: Which of the following statements regarding the

Q98: The tax rates for individuals who qualify