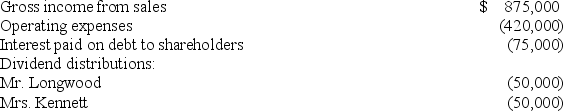

Mr.Longwood and Mrs.Kennett are the equal shareholders in LK Corporation.Both shareholders have a 37 percent marginal tax rate on ordinary income.LK's financial records show the following:

a.Compute the combined tax cost for LK,Mr.Longwood,and Mrs.Kennett attributable to LK's operations.

a.Compute the combined tax cost for LK,Mr.Longwood,and Mrs.Kennett attributable to LK's operations.

b.How would your computation change if the interest on the shareholder debt was $175,000 and LK paid no dividends?

Definitions:

Labor

The process of childbirth, beginning with contractions of the uterus and ending with the delivery of the baby.

Epidural

A medical procedure involving the injection of anesthesia into the epidural space of the spinal cord to provide pain relief, particularly during childbirth.

Spinal Canal

The cylindrical space within the spine that houses and protects the spinal cord.

Anesthesia

A medical intervention that results in partial or complete loss of sensation, often used to eliminate pain during surgery.

Q1: The highest individual marginal rate for regular

Q2: At the beginning of year 1,Paulina purchased

Q15: Ms.Jack operates a service business as a

Q44: Which of the following statements concerning the

Q48: Mr.Vernon owns stock in two S corporations,Able

Q51: Perry is a partner in a calendar

Q54: A Keogh plan for the benefit of

Q73: Linda and Raj are engaged to be

Q80: Which of the following items might an

Q92: A guaranteed payment may be designed to