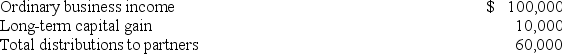

Mutt and Jeff are general partners in M&J Partnership and share profits and losses equally.Partnership operations for the current tax year were:  Mutt's tax basis in his partnership interest at the beginning of the current year was $12,000.What is his basis at the beginning of next year?

Mutt's tax basis in his partnership interest at the beginning of the current year was $12,000.What is his basis at the beginning of next year?

Definitions:

Alpha

In hypothesis testing, alpha level represents the threshold for rejecting the null hypothesis, often set at 0.05 or 5% risk of Type I error.

T-statistic

A statistic calculated from a dataset to compare the mean of the data to a hypothetical mean as part of a t-test.

Critical Value

The boundary value from a statistical distribution where, if the observed test statistic is beyond this point, the null hypothesis is rejected.

Null Hypothesis

A default statement suggesting that there is no statistical significance between the specified datasets, or no effect of a certain variable.

Q10: The IRS may conclude that a CEO/shareholder

Q24: The installment sale method of accounting is

Q36: Torquay Inc.'s (a calendar-year taxpayer)2018 taxable income

Q50: For a consolidated group of corporations,Schedule M-3

Q55: Mrs.Ford,who has a 37% marginal tax rate,is

Q56: Sonic Corporation has a 21% marginal tax

Q86: Thirty years ago,Prescott Inc.realized a $16,200 gain

Q91: Carman wishes to exchange 10 acres of

Q96: Which of the following statements regarding the

Q110: Vernon Inc.needs an additional worker on a