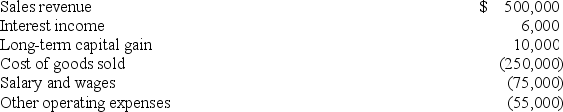

Waters Corporation is an S corporation with two equal shareholders,Mia Jones and David Kerns.This year,Waters recorded the following items of income and expense:  Waters distributed $25,000 to each of its shareholders during the year.Calculate the S corporation's ordinary (non-separately stated) income and indicate which items must be separately stated.

Waters distributed $25,000 to each of its shareholders during the year.Calculate the S corporation's ordinary (non-separately stated) income and indicate which items must be separately stated.

Definitions:

Four-Speed

Refers to a transmission or gear system with four forward gear ratios, often found in vehicles.

Hydromechanical Transmission

A type of transmission that combines hydraulic fluid power with mechanical gears to transmit power and adjust vehicle speed without manual gear changes.

Valve

A device that regulates, directs or controls the flow of a fluid by opening, closing, or partially obstructing various passageways.

Automatic Functions

Features or operations within a device, system, or vehicle that operate without manual intervention, often based on specific conditions or triggers.

Q14: Corporation F owns 95 percent of the

Q28: A fire destroyed equipment used by BLP

Q36: Torquay Inc.'s (a calendar-year taxpayer)2018 taxable income

Q39: Franton Co.,a calendar year,accrual basis corporation,reported $2,076,000

Q40: The difference between the before-tax cost and

Q63: Kaskar Company,a calendar year taxpayer,paid $3,350,000 for

Q71: In determining the incidence of the corporate

Q98: Powell Inc.was incorporated and began operations on

Q110: Vernon Inc.needs an additional worker on a

Q113: Mr.and Mrs.Kline file a joint return on