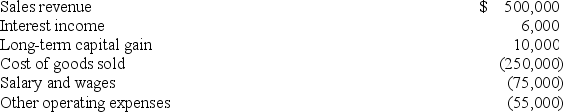

Waters Corporation is an S corporation with two equal shareholders,Mia Jones and David Kerns.This year,Waters recorded the following items of income and expense:  Waters distributed $25,000 to each of its shareholders during the year.If Mia's adjusted tax basis in her partnership interest was $50,000 at the beginning of the year,compute her adjusted tax basis in her partnership interest at the end of the year.

Waters distributed $25,000 to each of its shareholders during the year.If Mia's adjusted tax basis in her partnership interest was $50,000 at the beginning of the year,compute her adjusted tax basis in her partnership interest at the end of the year.

Definitions:

Survey

A research method that involves collecting data from a predefined group of respondents to gather information and insights on various subjects.

Adolescents

The phase of growth and development spanning the years between childhood and adulthood, often associated with the teenage period and marked by significant physical, emotional, and intellectual changes.

Free Time

refers to periods when an individual is not engaged in work or obligatory activities, allowing for rest, leisure, or pursuits of personal interest.

Intimate Relationships

Deeply personal and close connections between individuals, characterized by affection, love, trust, and mutual support.

Q8: Essco Inc.,a calendar year taxpayer,made two asset

Q9: A taxpayer who pays boot in a

Q20: The double taxation of corporate earnings is

Q22: Mann Inc.,a calendar year taxpayer,incurred $49,640 start-up

Q38: Uqua Inc.purchased a depreciable asset for $189,000.First-year

Q40: Multi-State,Inc.does business in two states.Its apportionment percentage

Q69: Honu,Inc.has book income of $1,200,000.Book income includes

Q89: The installment sale method of accounting applies

Q98: The tax rates for individuals who qualify

Q102: Hitz Company,a calendar year,accrual basis taxpayer,recorded $1,735