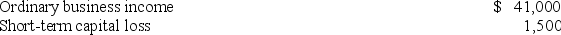

Alex is a partner in a calendar year partnership.His partnership Schedule K-1 for the current tax year showed the following:  Alex has a $7,000 loss carryforward from the partnership last year,which he could not deduct because of the basis limitation.What is his tax basis in his partnership interest at the end of the current tax year?

Alex has a $7,000 loss carryforward from the partnership last year,which he could not deduct because of the basis limitation.What is his tax basis in his partnership interest at the end of the current tax year?

Definitions:

Compounded Monthly

Calculating interest each month by adding it to both the original investment and the interest that has already been accumulated from past periods.

Quarterly Payments

Payments made four times a year at three-month intervals, often related to dividends or loan repayments.

Interest Rate

The expense a borrower bears for the use of funds from a lender, measured as a fraction of the principal.

Discount Rate

This term refers to the interest rate used in discounted cash flow analysis to figure out the current value of cash flows that will occur in the future.

Q6: The income earned by a foreign branch

Q20: Muro Inc.exchanged an old inventory item for

Q23: Fantino Inc.was incorporated in 2018 and adopted

Q38: Southlawn Inc.'s taxable income is computed as

Q52: Effective tax research often omits the first

Q68: Mrs.Raines died on June 2,2018.Mr.Raines has not

Q85: The net operating losses of a C

Q92: A basic premise of federal income tax

Q99: Mrs.Brinkley transferred business property (FMV $340,200; adjusted

Q100: In 2019,William Wallace's sole proprietorship,Western Wear Apparel,generated