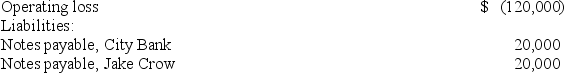

Cactus Company is a calendar year S corporation with the following current year information:  On January 1,John James bought 50% of Cactus Company stock for $30,000.How much of the operating loss may John deduct on his Form 1040? Assume the excess business loss limitation does not apply.

On January 1,John James bought 50% of Cactus Company stock for $30,000.How much of the operating loss may John deduct on his Form 1040? Assume the excess business loss limitation does not apply.

Definitions:

Confidentiality

The principle of maintaining privacy by not disclosing information shared in a trusted relationship, unless consented to or otherwise required by law.

Relative Confidentiality

A principle in certain professions where the confidentiality of client information is respected but may be overridden in specific circumstances determined by law or ethical guidelines.

Privilege

Special rights, advantages, or immunities granted or available only to a particular person or group of people.

Maximizing

The process of making the most or best use of resources, opportunities, or capabilities.

Q9: Mr.and Mrs.Steel,who file a joint return,have $513,200

Q17: Mega,Inc.,a U.S.multinational,has pretax U.S.source income and foreign

Q25: The accumulated earnings tax is assessed at

Q28: Nilex Company sold three operating assets this

Q28: In which of the following cases are

Q49: The shareholders of an S corporation must

Q74: The results of the tax research process

Q86: Slipper Corporation has book income of $500,000.Book

Q102: Hugo Inc.,a calendar year taxpayer,sold two operating

Q116: Mrs.Lincoln was employed by GGH Inc.until October,when