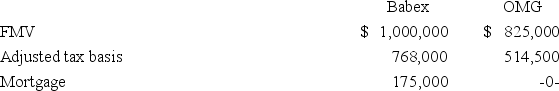

Babex Inc.and OMG Company entered into an exchange of real property.Here is the information for the properties to be exchanged.  Pursuant to the exchange,OMG assumed the mortgage on the Babex property.Compute OMG's gain recognized on the exchange and its tax basis in the property received from Babex.

Pursuant to the exchange,OMG assumed the mortgage on the Babex property.Compute OMG's gain recognized on the exchange and its tax basis in the property received from Babex.

Definitions:

Organic Matter

Material derived from living organisms, including plants, animals, and their byproducts, containing carbon compounds.

Proteins

are large, complex molecules made up of amino acids that play many critical roles in the body, including catalyzing metabolic reactions, DNA replication, responding to stimuli, and transporting molecules from one location to another.

Cytoplasm

The gel-like substance within a cell, excluding the nucleus, containing organelles and is involved in numerous cellular processes.

Plane

A flat, two-dimensional surface that extends infinitely in all directions.

Q6: On July 2,2019,a tornado destroyed an asset

Q34: The four primary legal characteristics of a

Q46: A controlled foreign corporation is a foreign

Q49: The general rule is that a net

Q57: The Citator is a rarely used,unimportant source

Q63: Private letter rulings and technical advice memoranda

Q82: Kuong Inc.sold a commercial office building used

Q92: A basic premise of federal income tax

Q102: Hitz Company,a calendar year,accrual basis taxpayer,recorded $1,735

Q107: Gowda Inc.,a calendar year taxpayer,purchased $1,496,000 of