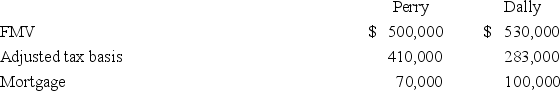

Perry Inc.and Dally Company entered into an exchange of real property.Here is the information for the properties to be exchanged.  Pursuant to the exchange,Perry assumed the mortgage on the Dally property,and Dally assumed the mortgage on the Perry property.Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

Pursuant to the exchange,Perry assumed the mortgage on the Dally property,and Dally assumed the mortgage on the Perry property.Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

Definitions:

Content Producers

Individuals or entities responsible for creating, editing, and managing content, such as articles, videos, and podcasts, usually for digital platforms.

Fashion Models

Individuals hired to display clothing and accessories by wearing them in shows, photo shoots, or advertising to promote sales.

Athletic Stadium Sponsorship

A marketing strategy where a company provides financial support to a sports facility in exchange for brand exposure and advertising rights.

NFL And MLB Teams

Professional sports teams associated with the National Football League (NFL) and Major League Baseball (MLB) in the United States.

Q2: Start-up losses of a new business operation

Q13: Section 482 of the Internal Revenue Code

Q37: In today's tax environment,the opportunity for individuals

Q37: All general partners have unlimited personal liability

Q41: Under the U.S.tax system,a domestic corporation pays

Q54: Mrs.Beld sold marketable securities with a $79,600

Q72: A personal holding company is a corporation

Q82: Grantly Seafood is a calendar year taxpayer.In

Q83: Tax evasion is a federal crime punishable

Q104: Milton Inc.recognized a $1,300 net Section 1231