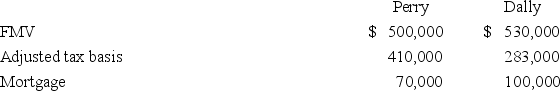

Perry Inc.and Dally Company entered into an exchange of real property.Here is the information for the properties to be exchanged.  Pursuant to the exchange,Perry assumed the mortgage on the Dally property,and Dally assumed the mortgage on the Perry property.Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

Pursuant to the exchange,Perry assumed the mortgage on the Dally property,and Dally assumed the mortgage on the Perry property.Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

Definitions:

Idle Capacity

The condition when resources, typically manufacturing or production facilities, are available but not in use.

Activity Rates

The costs assigned to specific activities, used in activity-based costing to allocate overhead costs more accurately.

Activity Cost Pools

Categories in activity-based costing that aggregate indirect costs incurred by multiple cost objects, allowing for more precise allocation.

Activity-Based Costing

Activity-Based Costing is a method that assigns costs to products or services based on the activities they require, aiming for more accurate allocation of overhead.

Q16: Which of the following is not administrative

Q19: Mr.Dilly has expenses relating to a qualifying

Q28: Corporations are allowed a deduction for charitable

Q44: Eliot Inc.transferred an old asset with a

Q64: When performing step three of the tax

Q86: Which of the following statements describes a

Q88: B&P Inc.,a calendar year corporation,purchased only one

Q99: Randolph Scott operates a business as a

Q99: Which of the following statements regarding S

Q102: Hugo Inc.,a calendar year taxpayer,sold two operating