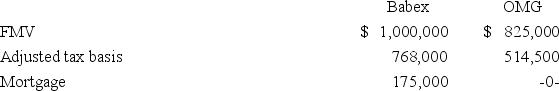

Babex Inc.and OMG Company entered into an exchange of real property.Here is the information for the properties to be exchanged.  Pursuant to the exchange,OMG assumed the mortgage on the Babex property.Compute Babex's gain recognized on the exchange and its tax basis in the property received from OMG.

Pursuant to the exchange,OMG assumed the mortgage on the Babex property.Compute Babex's gain recognized on the exchange and its tax basis in the property received from OMG.

Definitions:

Cultural Tunnel Vision

A limited or narrow perspective that fails to recognize or appreciate cultural diversity and complexities.

Cultural Implications

The effects that culture has on various aspects of society and individuals, including behaviors, beliefs, and practices.

Limited Cultural Experiences

The condition of having a narrow exposure to diverse cultures, traditions, and lifestyles, leading to a lack of understanding and appreciation for cultural differences.

Conceptual Framework

An analytical tool that is used to organize, define, and guide the theoretical treatment of a problem, comprising concepts, theories, and the relationships between them.

Q8: Accurate measurement of taxable income is the

Q15: Why does the federal tax law disallow

Q27: This year,Nigle Inc.'s auditors required the corporation

Q32: Which of the following entities does not

Q34: Tri-State's,Inc.operates in Arkansas,Oklahoma,and Kansas.Assume that each state

Q48: Doppia Company transferred an old asset with

Q77: Cross-crediting allows multinational corporations to use excess

Q79: Following the rate reductions of the Tax

Q90: Generally,the corporate income tax is computed using

Q106: The foreign tax credit is available for