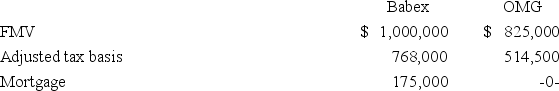

Babex Inc.and OMG Company entered into an exchange of real property.Here is the information for the properties to be exchanged.  Pursuant to the exchange,OMG assumed the mortgage on the Babex property.Compute OMG's gain recognized on the exchange and its tax basis in the property received from Babex.

Pursuant to the exchange,OMG assumed the mortgage on the Babex property.Compute OMG's gain recognized on the exchange and its tax basis in the property received from Babex.

Definitions:

Psychological Response

An individual's emotional and mental reaction to a particular stimulus or situation, which can influence behavior and decision-making.

Time Management Matrix

A tool used to categorize tasks based on their urgency and importance, helping individuals prioritize their time effectively.

Quadrants

A four-part division, often used in graphs, charts, or matrices to organize information or data into distinct sections for analysis or decision-making.

Interruptions

Breaks or disturbances that halt or disrupt a conversation, activity, or process.

Q3: Mr.and Mrs.King's regular tax liability on their

Q4: Most tax credits for which a corporate

Q8: Revenue procedures are a type of secondary

Q11: Dender Company sold business equipment with a

Q29: Dolzer Inc.sold a business asset with a

Q31: A family partnership can be used to

Q45: Betsy Williams is the sole shareholder of

Q50: The goal of tax planning is to

Q50: If a trial court decision has been

Q92: Both corporate and individual taxpayers may be