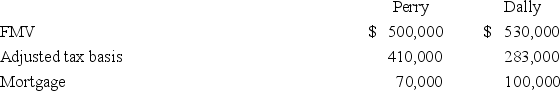

Perry Inc.and Dally Company entered into an exchange of real property.Here is the information for the properties to be exchanged.  Pursuant to the exchange,Perry assumed the mortgage on the Dally property,and Dally assumed the mortgage on the Perry property.Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

Pursuant to the exchange,Perry assumed the mortgage on the Dally property,and Dally assumed the mortgage on the Perry property.Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

Definitions:

Values

are the fundamental beliefs and principles that guide a person's behavior and decision-making, reflecting what is important to an individual or group.

Sex

A biological classification based on reproductive organs and chromosomal configurations, typically categorized as male or female.

Gender

The range of characteristics pertaining to, and differentiating between, masculinity and femininity, including social roles, behaviors, and identities.

Racism

Prejudice, discrimination, or antagonism directed against someone of a different race based on the belief that one's own race is superior.

Q16: For the current tax year,Cuddle Corporation's $500,000

Q23: Which of the following statements regarding the

Q31: If Gamma Inc.is incorporated in Ohio and

Q40: Joanna has a 35% marginal tax rate

Q47: Mr.and Mrs.Luang reported $1,417,900 ordinary taxable income

Q68: Pennworth Corporation operates in the United States

Q75: In the citation Rev.Proc.2002-32,2002-1 C.B.959,the abbreviation C.B.refers

Q82: Kuong Inc.sold a commercial office building used

Q88: B&P Inc.,a calendar year corporation,purchased only one

Q91: A partner's tax basis in his or