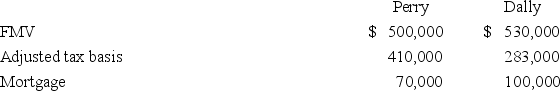

Perry Inc.and Dally Company entered into an exchange of real property.Here is the information for the properties to be exchanged.  Pursuant to the exchange,Perry assumed the mortgage on the Dally property,and Dally assumed the mortgage on the Perry property.Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

Pursuant to the exchange,Perry assumed the mortgage on the Dally property,and Dally assumed the mortgage on the Perry property.Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

Definitions:

Loanable Funds

The market where savers provide funds to borrowers, usually influencing interest rates.

Foreign-Currency Exchange

The conversion of one currency into another currency, a critical process for international trade, travel, and investment.

Canadian Company

A business entity that is registered, operates, or was founded in Canada.

Real Exchange Rate

The price of a country's goods and services compared to those of another country, adjusted for inflation.

Q15: Which of the following is not a

Q17: Follen Company is a calendar year taxpayer.On

Q29: Gwen and Travis organized a new business

Q43: Several years ago,Nipher paid $70,000 to purchase

Q76: O&V sold an asset with a $78,300

Q78: Assuming that the corporation has a 21%

Q94: A corporation that owns more than $10

Q96: If a business is formed as a

Q109: A tornado demolished several delivery vans owned

Q120: In 2018,TPC Inc.sold investment land with a