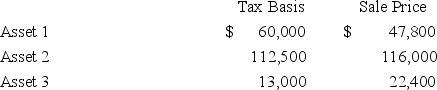

Gupta Company made the following sales of capital assets this year.  What is the effect of the three sales on Gupta's taxable income?

What is the effect of the three sales on Gupta's taxable income?

Definitions:

Innovator

A person or entity that introduces new ideas, methods, or products.

Product Placement

The practice of intentionally placing specific products in entertainment media to promote visibility and sales.

Advergaming

The use of video games as a medium to promote brands, products, or messages, often engaging users in an interactive experience.

Advertising Pop-Ups

Online advertisements that appear in a new window on top of website content, often interrupting the viewer's experience.

Q10: For tax purposes,income is recognized when all

Q48: A Citator may be used to determine

Q51: Mandrake,Inc.has book income of $569,300.Its income includes

Q54: Taxpayers may adopt the cash receipts and

Q62: Tregor Inc.,which manufactures plastic components,rents equipment on

Q63: Poole Company,a calendar year taxpayer,incurred $589 of

Q64: When performing step three of the tax

Q69: A fire destroyed business equipment that was

Q80: Deitle Inc.manufactures small appliances.This year,Deitle capitalized $3,679,000

Q83: Corporations cannot be shareholders in an S