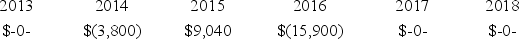

Proctor Inc.was incorporated in 2013 and adopted a calendar year.Here is a schedule of Proctor's net Section 1231 gains and (losses) reported on its tax returns through 2018.  In 2019,Proctor recognized a $25,000 gain on the sale of business land.How is this gain characterized on Proctor's tax return?

In 2019,Proctor recognized a $25,000 gain on the sale of business land.How is this gain characterized on Proctor's tax return?

Definitions:

Aerosols

Very small solid particles or drops of liquid dispersed in the atmosphere.

Fissure Eruptions

A volcanic eruption characterized by the release of lava from long cracks or fissures in the Earth's surface, typically resulting in the formation of extensive lava flows.

Lava Fountains

High-speed bursts of molten rock that are ejected from a volcano or vent.

Volcanic Blocks

Large chunks of solid rock ejected from a volcano during an eruption, distinct from smaller pyroclastic materials.

Q4: Which of the following statements about tax

Q11: Moses Inc.purchased office furniture for $8,200 plus

Q20: Mr.Crum,an architect,billed a client $12,500 for professional

Q53: CBM Inc.realized a $429,000 gain on sale

Q63: Mrs.Day structures a transaction to shift income

Q67: On January 1 of this year,Conrad Nelson

Q67: Which of the following statements regarding secondary

Q67: Durna Inc.,a calendar year taxpayer,made two asset

Q94: Which of the following expenditures must be

Q98: Rydell Company exchanged business realty (initial cost