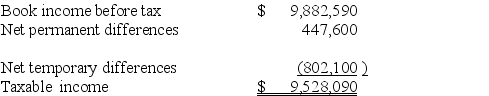

B&B Inc.'s taxable income is computed as follows:  Using a 21% rate,compute B&B's tax expense per books and tax payable.

Using a 21% rate,compute B&B's tax expense per books and tax payable.

Definitions:

Classical Conditioning

An educational technique that pairs two stimuli together repeatedly; a response that at first occurs due to the second stimulus alone eventually results from the first stimulus.

Social Learning Theory

The theory emphasizing that learning occurs within a social context, and knowledge is acquired through observing others in the social environment.

Observational Learning

A method of gaining behaviors by observing and mimicking the actions of others.

Operant Conditioning

A method of learning that employs rewards and punishments for behavior, leading to changes in voluntary behavior.

Q6: When did the federal income tax become

Q7: The gain or loss recognized on any

Q12: On May 1,Sessi Inc.,a calendar year corporation,purchased

Q19: Cosmo Inc.purchased an asset costing $67,500 by

Q19: Tax liability divided by taxable income equals

Q22: Marginal rate uncertainty includes the risk that

Q30: Corporations,LLCs,and partnerships are all taxable entities.

Q65: Which tax raises the most revenue for

Q69: Jelk Company is structuring a transaction that

Q95: On December 19,2019,Acme Inc.,an accrual basis corporation,accrued