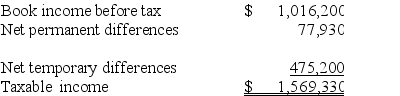

Goff Inc.'s taxable income is computed as follows:  Goff's tax rate is 21%.Which of the following statements is true?

Goff's tax rate is 21%.Which of the following statements is true?

Definitions:

Absorption Costing

A costing method that includes all manufacturing costs - direct materials, direct labor, and both variable and fixed manufacturing overhead - in the cost of a product.

Total Gross Margin

The difference between the sales revenue and the cost of goods sold, indicating the total profitability from goods sold.

Absorption Costing

A pricing approach that encompasses all costs related to production - including direct materials, direct labor, as well as both variable and fixed overhead expenses - within the product’s cost.

Absorption Costing

A method of accounting that includes all manufacturing costs, both variable and fixed, in the valuation of inventory and cost of goods sold.

Q1: Jurisdiction M imposes an individual income tax

Q8: A progressive rate structure and a proportionate

Q9: The tax law provides that individuals do

Q30: Firms engaged in the extraction of natural

Q32: George and Martha formed a partnership by

Q37: Mr.Quest plans to engage in a transaction

Q44: Mr.Jessel sold 4,200 shares of stock in

Q63: Poole Company,a calendar year taxpayer,incurred $589 of

Q75: Grant Wilson is an employee of Market

Q115: B&I Inc.sold a commercial office building used