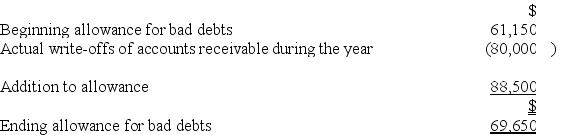

Monro Inc.uses the accrual method of accounting.Here is a reconciliation of Monro's allowance for bad debts for the current year.  Which of the following statements is true?

Which of the following statements is true?

Definitions:

Standard Deduction

The fixed amount the IRS allows taxpayers to subtract from their taxable income if they do not itemize deductions, differing by filing status.

Exemption

A provision that reduces or eliminates a taxpayer's obligation to pay tax, typically based on certain conditions or qualifications.

Tax Bill

A statement from a government authority specifying the amount of tax owed by an individual or entity.

Proration

The allocation or division of financial amounts based on a proportionate distribution, often applied in billing, refunds, or dividends.

Q3: This year,Ms.Lucas sold investment land for $125,000

Q8: A progressive rate structure and a proportionate

Q23: Fantino Inc.was incorporated in 2018 and adopted

Q23: Belsap Inc.,a calendar year taxpayer,purchased a total

Q34: Which of the following statements does not

Q44: Carter Inc.and CCC Inc.are owned by the

Q49: Which of the following statements about boot

Q60: Stack Inc.owns a $1 million insurance policy

Q68: A deduction is worth twice as much

Q152: If you never married,you don't need to