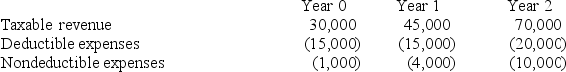

Mrs.Biggs invested in a business that will generate the following cash flows over a three-year period.Use Appendix A.  If Mrs.Biggs' marginal tax rate over the three-year period is 30% and she uses a 6% discount rate,compute the NPV of the transaction.

If Mrs.Biggs' marginal tax rate over the three-year period is 30% and she uses a 6% discount rate,compute the NPV of the transaction.

Definitions:

Punisher

Anything that follows a response and weakens it or decreases the probability that it will occur.

Strengthens

To make or become stronger or more resilient, often used in the context of physical, emotional, or mental attributes.

Weakens

To diminish in strength, effectiveness, or power.

Primary Reinforcement

A stimulus that satisfies a basic biological need and inherently reinforces a behavior, such as food for hunger.

Q29: The tax cost of a transaction represents

Q36: The U.S.individual income tax has always used

Q50: Which of the following capitalized cost is

Q59: Which of the following statements about discount

Q68: Which of the following is not characteristic

Q69: In estate planning,if you are married:<br>A)you do

Q70: Editorial explanations provided by electronic tax services

Q70: Life insurance may be a reasonable,feasible,and economical

Q75: Mr.Wills invested in a business that will

Q107: Which type of housing is preferred by