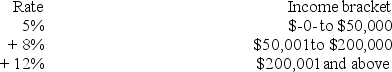

Jurisdiction M imposes an individual income tax based on the following schedule.  Which of the following statements is false?

Which of the following statements is false?

Definitions:

Comparative Consolidated Financial Statements

Financial statements that provide financial information for multiple periods, offering a way to compare a company's financial performance over time.

Acquisition Differential

The difference between the cost of acquiring a company and the fair value of its identifiable net assets, often recognized as goodwill.

Business Combination

A transaction or event in which an acquirer gains control over one or more businesses, merging entities into one operational unit.

Voting Shares

Voting shares are shares of a company's stock that grant the shareholder the right to vote on corporate policy and the composition of the board of directors.

Q1: Jurisdiction M imposes an individual income tax

Q19: Tax liability divided by taxable income equals

Q28: Which of the following is not a

Q63: The sales tax laws of many states

Q64: Vervet County levies a real property tax

Q67: A newly practicing surgeon,who will soon finish

Q68: The statement that "an old tax is

Q69: Last year,Government G levied a 35% tax

Q97: Commercial property refers to land and buildings

Q137: Over the last two decades,the defined-benefit plan