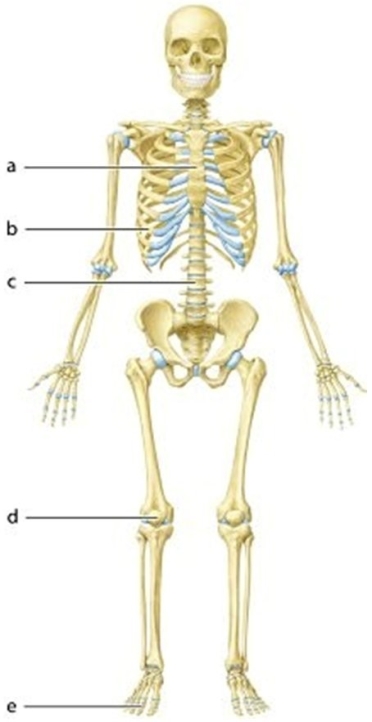

-Classify bone "e" based on shape.

Definitions:

Tax Year

The 12-month period for which tax is calculated. It can be a calendar year or a fiscal year, depending on the taxpayer.

Depreciation Expense

A non-cash expense that reduces the value of an asset over time due to wear and tear, ageing, or obsolescence.

Schedule E

Schedule E is a form used for tax filing in the U.S. that reports income and losses from rental property, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs.

IRS Method

A term not specifically defined but often refers to the procedures, formulas, or rules established by the IRS for calculating taxes, deductions, and credits.

Q3: Which image corresponds to metaphase?<br>A)A<br>B)B<br>C)C<br>D)D

Q5: Your patient has a deviated septum. What

Q5: Corporate welfare does not have a direct

Q6: Recent population trends are likely to lead

Q11: Why does a positive pregnancy test have

Q16: Which of these can release hydroxide ions?<br>A)Buffers<br>B)Bases

Q24: One's personality traits have no bearing on

Q27: What is the function of the cell

Q35: In 2009 the unemployment rate in the

Q49: The degree to which the helper can