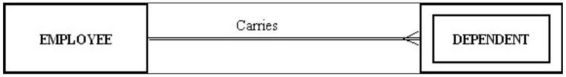

The following figure shows an example of:

Definitions:

Earnings and Profits

A term used in corporate taxation to refer to the after-tax profits of a corporation, often affecting dividend distributions.

Dividends

Payments made by a corporation to its shareholders, representing a portion of the company's earnings.

Net Capital Gain

The profit from the sale of an investment or property, calculated as the difference between the sale price and the original purchase price after adjusting for various factors such as brokerage fees, taxes, and improvements.

Preferential Tax Rates

Lower tax rates applied to certain types of income, such as long-term capital gains and qualified dividends, compared to ordinary income tax rates.

Q11: A fat client does most of its

Q13: An open source DBMS is:<br>A) a free

Q20: A simultaneous relationship among the instances of

Q49: In a supertype/subtype hierarchy, each subtype has:<br>A)

Q52: A fact is an association between two

Q54: In the figure below, the primary key

Q65: In the figure below, a student: <img

Q65: The allowable range of values for a

Q82: The number of entity types that participate

Q91: What results will be produced by the