Comparative Financial Statements for Tomtric Company Follow Additional Data on Activities During 2019 Are as Follows:

•

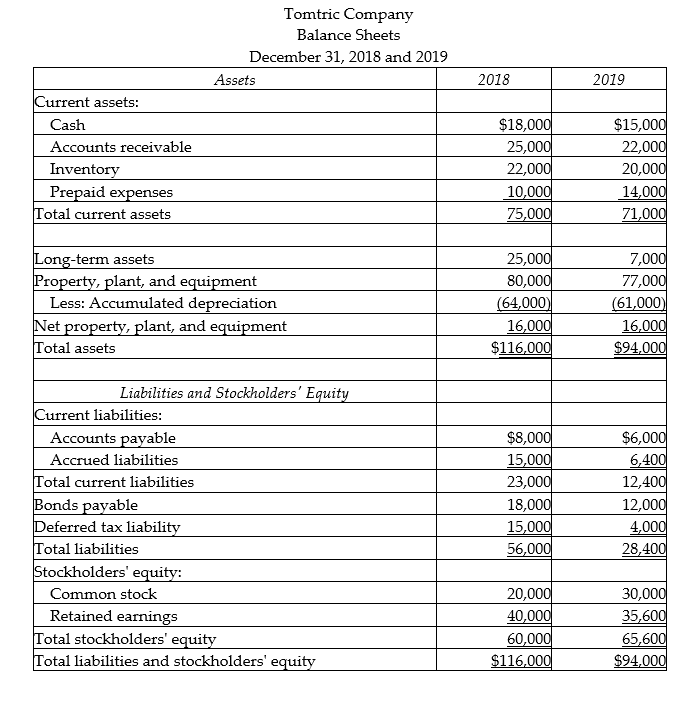

Comparative financial statements for Tomtric Company follow:

Additional data on activities during 2019 are as follows:

• During 2019, Tomtric Company sold used equipment for $3,000 that had cost $15,000 with accumulated depreciation of $8,000.

• New equipment was purchased for $12,000 cash.

• Cash dividends totaling $8,000 were paid.

• Long-term investments that had cost $18,000 when purchased were sold for $18,000.

• Common stock was issued for $10,000.

Required:

Prepare the financing activities section of the statement of cash flows.

Definitions:

Behavioural Scientists

Researchers and practitioners who study the interactions and behaviors of humans and animals within their environments.

Organizational Charts

Visual representations that illustrate the structure of an organization, showing relationships and ranks of jobs.

Punctuated Equilibrium

A theory originally from evolutionary biology, applied to organizational change, suggesting that long periods of stability are interrupted by brief phases of significant change.

Critical Point

A decisive moment or threshold in a process or system where significant change occurs, often leading to a new state or condition.

Q10: An enterprise data model describes the scope

Q14: If the lease term must be greater

Q21: A _ allows a single SQL statement

Q38: When pension plan assets exceed pension plan

Q41: What types of accounts are typically affected

Q43: Replication should NOT be used if timely

Q56: Cash paid for merchandise is calculated as

Q68: When a company amends their existing pension

Q73: A stock option plan is generally revalued

Q83: When computing basic EPS, the numerator includes