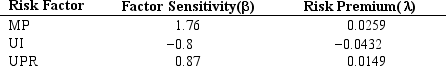

The table below provides factor risk sensitivities and factor risk premia for a three factor model for a particular asset where factor 1 is MP the growth rate in U.S. industrial production, factor 2 is UI the difference between actual and expected inflation, and factor 3 is UPR the unanticipated change in bond credit spread.  Calculate the expected excess return for the asset.

Calculate the expected excess return for the asset.

Definitions:

Soybeans

A type of legume native to East Asia, widely grown for its edible bean which has numerous uses, including oil and protein sources.

Mad Cow Disease

A fatal brain disease in cattle that can potentially be transmitted to humans who consume tainted beef, scientifically known as Bovine Spongiform Encephalopathy (BSE).

Competitive Market

A market structure where there are many buyers and sellers, no single entity controls the prices, and there is freedom of entry and exit.

Quantity of Corn Demanded

This term refers to the total amount of corn that consumers are willing and able to purchase at a given price level and period.

Q22: Some factors that determine financial risk include

Q34: The Absolute Finance Company (AFC) earned $5

Q38: The correlations among the U.S. investment-grade-bond series

Q40: Calculate the expected return for A Industries

Q45: Which of the following statements about industry

Q46: The National Bureau of Economic Research (NBER)

Q63: In well developed economies, markets are not

Q70: Refer to Exhibit 4.7. At the end

Q73: Which of the following statements about a

Q75: Abnormal returns associated with rankings by a