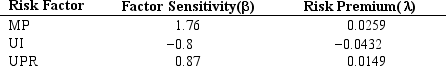

The table below provides factor risk sensitivities and factor risk premia for a three factor model for a particular asset where factor 1 is MP the growth rate in U.S. industrial production, factor 2 is UI the difference between actual and expected inflation, and factor 3 is UPR the unanticipated change in bond credit spread.  Calculate the expected excess return for the asset.

Calculate the expected excess return for the asset.

Definitions:

Peak Season

The time period when demand for a particular service or product is at its highest, often leading to increased prices and activity.

Economic Slump

A period characterized by a decline in economic activity, marked by reduced consumer spending, lower production, and increased unemployment.

Positive Communication

The practice of conveying messages in a constructive, optimistic, and encouraging manner.

Project's Account

An account specifically designated for managing the finances, transactions, and budget related to a particular project.

Q10: The dividend growth models are only meaningful

Q15: An equally weighted indicator series is also

Q28: The financial risk for the retail store

Q35: Refer to Exhibit 5.6. Compute the arithmetic

Q53: Under the following conditions, what are the

Q57: The capital goods industry typically outperforms other

Q74: It is more important to estimate future

Q106: Refer to Exhibit 8.3. What is the

Q116: You are attempting to estimate expected earnings

Q119: Refer to Exhibit 12.8. What is the