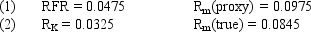

Assume that as a portfolio manager the beta of your portfolio is 0.85 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

Definitions:

First-degree Price Discrimination

A pricing strategy where a seller charges the maximum possible price for each unit consumed, tailored to the buyer's willingness to pay.

Incremental Revenue

The additional income received from selling one more unit of a product or service.

Marginal Revenue

The additional income received from selling one more unit of a good or service; it is a critical concept in deciding the optimal quantity of goods to produce.

Price Discrimination

The practice of charging different prices to different consumers for the same product or service, based on their willingness to pay.

Q3: Foreign equities can be acquired by purchasing

Q6: Refer to Exhibit 10.2. What was the

Q9: Refer to Exhibit 13.1. Estimate the industry

Q18: The Efficient Frontier refers to a set

Q25: Refer to Exhibit 7.3. What is the

Q25: If statistical tests of stock returns over

Q34: The Absolute Finance Company (AFC) earned $5

Q41: A study by Chen, Roll, and Ross

Q80: Refer to Exhibit 10.8. Calculate Zeco Company's

Q119: Refer to Exhibit 12.8. What is the