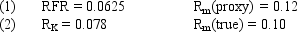

Assume that as a portfolio manager the beta of your portfolio is 1.15 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

Definitions:

Student T Distribution

A probability distribution that is used in hypothesis testing for small sample sizes or when the population standard deviation is unknown.

Expected Value

A statistical concept representing the average outcome one would expect to see from a probability distribution over many trials.

Exponential Distribution

A model used in statistics for describing the times between events in a process where events occur continuously and independently at a constant rate.

Proportion

A fraction or percentage that indicates the part of a whole represented by a certain count or quantity.

Q35: Refer to Exhibit 4.7. At the end

Q35: According to the semistrong-form efficient market hypothesis,

Q44: Which index is created by first deriving

Q47: Specialists provide added liquidity in the Nasdaq

Q60: The member of the New York Stock

Q63: A trading rule which signals purchase of

Q65: An individual with only $10,000 to invest

Q82: The Value Line Composite Average is calculated

Q97: Semivariance, when applied to portfolio theory, is

Q105: If you borrow money at the RFR