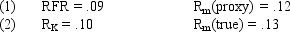

Assume that as a portfolio manager the beta of your portfolio is 1.2 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

Definitions:

Continuous Reinforcement

A strategy in which a desired behavior is reinforced every time it occurs, leading to quick learning of the behavior.

Behavior Modification

A psychological strategy for altering undesirable behaviors through reinforcement, punishment, and other interventions.

Occasional Praise

The act of expressing approval or admiration infrequently or at irregular intervals, often used as a motivational tool in personal and professional contexts.

Mentor Relationships

The dynamic between a more experienced individual (mentor) and a less experienced individual (mentee), geared towards the latter's personal and professional development.

Q21: An investor wishes to construct a portfolio

Q32: Inventory turnover, net fixed asst turnover and

Q49: Refer to Exhibit 10.1. What was BMC'S

Q51: Using the constant growth model, an increase

Q53: The growth of business depends on the

Q57: Refer to Exhibit 9.3. Calculate the expected

Q73: Certificates of ownership issued by a U.S.

Q76: A completely diversified portfolio would have a

Q76: Yields on money market funds are often

Q77: Refer to Exhibit 10.9. Calculate the profit