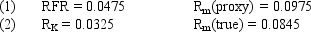

Assume that as a portfolio manager the beta of your portfolio is 0.85 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

Definitions:

One-Way ANOVA

A statistical test that compares the means of three or more independent groups to determine if there are any statistically significant differences among the groups.

Rejection Region

The range of values for which the null hypothesis is not considered plausible and is rejected in hypothesis testing.

Single-Factor ANOVA

A statistical technique used to compare the means of three or more samples using variance analysis on a single independent variable.

Test Statistic

A calculated value used in statistical hypothesis testing to determine whether to reject the null hypothesis.

Q22: Refer to Exhibit 12.5. Calculate the firm's

Q41: The Dow Jones Industrial Average is a

Q47: Future tax rates are difficult to estimate

Q48: The Capital Market Line (CML) can be

Q50: All of the following are ways to

Q59: Refer to Exhibit 11.6. The present value

Q74: Refer to Exhibit 5.5. Calculate the unweighted

Q97: The betas for the market portfolio and

Q110: Which of the following is not a

Q117: Refer to Exhibit 12.2. What is your