-An investment has a standard deviation of 12 percent and an expected return of 7 percent. What is the coefficient of variation for this investment?

Definitions:

Superior Returns

Financial gains that exceed the average market return or benchmarks, often sought by investors.

Relative Strength

A momentum investing technique that compares the performance of a security or index to the overall market or a specific benchmark.

Technical Analysts

Financial professionals who evaluate securities by analyzing statistics generated by market activity, such as past prices and volume.

Retail Industry

A sector of the economy that consists of individuals and companies engaged in the selling of finished products to end user consumers.

Q13: Refer to Exhibit 6.4. What is the

Q33: Investing 30 to 40 percent of your

Q34: Which of the following is least likely

Q39: Banks face regulatory constraints at both the

Q47: The rate of exchange between certain future

Q50: Refer to Exhibit 7.10. What is the

Q55: The random walk hypothesis contends that stock

Q66: Escalation bias refers to the situation where<br>A)Investors

Q81: The Morgan Stanley group index for Europe,

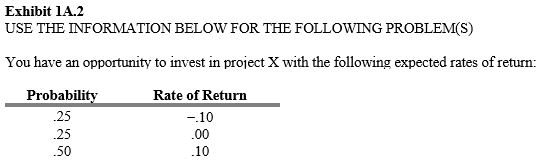

Q85: What is the expected return of the