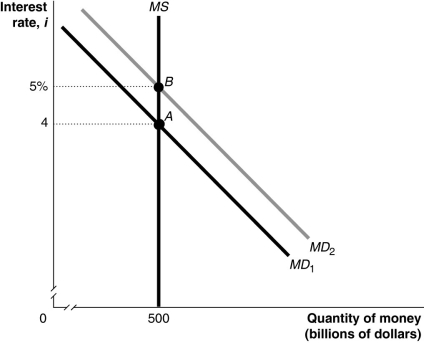

Figure 26-5

-Refer to Figure 26-5. In the figure above, the movement from point A to point B in the money market would be caused by

Definitions:

Capital Gain/Loss

The increase or decrease in the value of an investment or real estate, calculated by the difference between the purchase price and the sale price.

Par Value

The face value of a bond or stock as stated by the issuer, which is the amount paid to the holder at maturity for bonds, or the nominal value of a share.

Semiannual Coupon Bond

A type of bond that pays interest to its holder twice a year at regular intervals.

Market Interest

Refers to the general level of interest rates in the market at any given time, affecting how much it costs to borrow money or the returns on investments.

Q18: Hyperinflation can be caused by<br>A) the government

Q46: The federal government debt _ when the

Q56: A decrease in the marginal income tax

Q78: Commodity money is a good<br>A) used as

Q104: The quantity theory of money assumes that<br>A)

Q143: Which of the following is not an

Q155: If the Fed lowers its target for

Q205: In an economy with money, as opposed

Q246: If the Federal Reserve targets the money

Q250: Refer to Table 26-5. Suppose the table