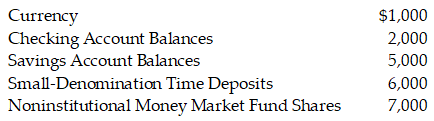

Scenario 25-1

-Refer to Scenario 25-1. M2 in this simple economy equals

Definitions:

Duration

A measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates, often expressed in years.

Par Value

The face value of a bond or the stock value stated in the corporate charter, often used in reference to bonds.

Immunization

A strategy used in fixed income to shield a portfolio from interest rate fluctuations by aligning the durations of assets and liabilities.

Duration Matching

Duration matching is an investment strategy used to minimize the interest rate risk by matching the duration of assets and liabilities, ensuring changes affect both sides similarly.

Q37: Suppose you decide to borrow money from

Q42: When the Fed uses contractionary policy<br>A) the

Q50: Why do banks create money? Do they

Q63: The Fed's two main monetary policy targets

Q91: According to the quantity theory of money,

Q191: The quantity equation states that<br>A) the money

Q213: Banks can continue to make loans until

Q226: Suppose that the required reserve ratio is

Q247: Historically, the largest U.S. federal budget deficits

Q310: Suppose the president is successful in passing