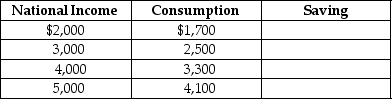

Table 23-8

-Given Table 23-9 below, fill in the values of the marginal propensity to save (MPS) and the marginal propensity to consume (MPC). Show that MPC + MPS = 1.

Definitions:

Marginal Tax Rates

The tax rate applicable to the last dollar of income earned, reflecting the percentage of tax applied to your income for each tax bracket in which you qualify.

Straight-Line Depreciation

A method of allocating the cost of a tangible asset evenly over its useful life.

Net Advantage to Leasing

This refers to the total financial benefits that a company might gain from leasing assets rather than purchasing them outright, taking into account tax advantages, cash flow, and risk factors.

CCA Rate

The Capital Cost Allowance (CCA) rate refers to the percentage rate at which a business can claim depreciation on certain property types for tax purposes in Canada.

Q138: A decrease in investment causes the price

Q144: Refer to Figure 24-3. Suppose the economy

Q160: Outline the various actions the government sector

Q160: If GDP per capita rises by 2%

Q203: Firms free ride on the research and

Q229: Refer to Figure 24-3. Which of the

Q249: Which of the following reasons has been

Q261: An economy that grows too slowly fails

Q271: C = 2,550 + (MPC)Y<br>I = 800<br>G

Q274: At each of the three points in