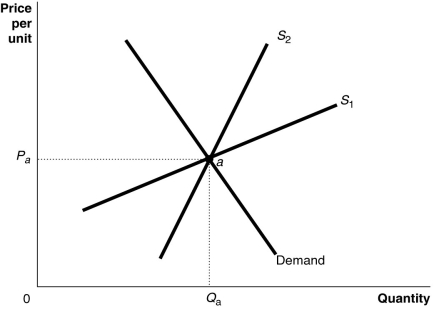

Figure 18-3

-Refer to Figure 18-3. The figure above shows a demand curve and two supply curves, one more elastic than the other. Use Figure 18-3 to answer the following questions.

a. Suppose the government imposes an excise tax of $1.00 on every unit sold. Use the graph to illustrate the impact of this tax when the supply curve is S1 and when the supply curve is S2.

b. If the government imposes an excise tax of $1.00 on every unit sold, will the consumer pay more of the tax if the supply curve is S1 or S2? Refer to the graphs in your answer.

c. If an excise tax of $1.00 on every unit sold is imposed, will the revenue collected by the government be greater if the supply curve is S1 or S2?

d. If the government imposes an excise tax of $1.00 on every unit sold, will the deadweight loss be greater if the supply curve is S1 or S2?

Definitions:

RUPA Partnership Test

The criteria established under the Revised Uniform Partnership Act to determine the existence of a partnership, focusing on the intention to carry on as co-owners of a business for profit.

Startup Business

A nascent company aiming to fill a gap in the market and rapidly grow in terms of customers and revenues.

Liability

The state of being legally responsible for something, typically referring to the obligation to compensate others for loss or damage caused by one’s actions.

Control

The power or authority to manage, direct, or influence something or someone's actions or operations.

Q9: If inflation is unanticipated, no redistribution of

Q47: The purchase by a household in China

Q52: Competitive markets tend to eliminate economic discrimination,

Q62: The distribution of income typically refers to

Q84: Workers who dislike risk<br>A) prefer to be

Q106: The deflation of the 1930s impacted the

Q159: If income is unequally distributed in an

Q204: Refer to Table 18-3. The table above

Q230: Marla is an architect who is designing

Q258: Which of the following are not considered