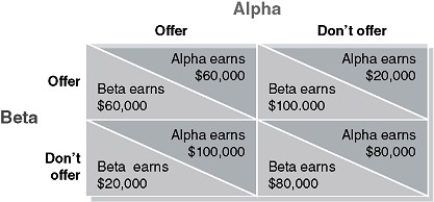

Table 14-4

Alpha and Beta are the only firms selling gyros in the upscale town of Delphi. Each firm must decide on whether to offer a discount to students to compete for customers. If one firm offers a discount but the other does not, then the firm that offers the discount will increase its profit. Table 14-4 shows the payoff matrix for this game.

-Refer to Table 14-4.If Alpha assumes that Beta would offer a student discount, what should it do?

Definitions:

IPOs

Initial Public Offerings, the process by which a private company offers shares to the public for the first time.

Issuing Securities

The process by which a corporate entity raises capital by distributing new stocks, bonds, or other financial instruments to investors.

Direct Private Long-term Debt Financing

A financing method where businesses borrow money directly from private investors or institutions under long-term agreements, without going through public markets.

Public Issues

Securities or debts that are offered to the public in an initial offering.

Q5: Which of the following is not a

Q17: Provide two examples of a government barrier

Q50: Refer to Figure 14-4. What is the

Q53: In evaluating the degree of economic efficiency

Q148: Which of the following is not among

Q164: Refer to Table 14-10. Suppose the payoff

Q203: Does the strength of each of the

Q204: Identify the type of merger in each

Q210: Is a monopolistically competitive firm productively efficient?<br>A)

Q230: Refer to Figure 14-4. In a real