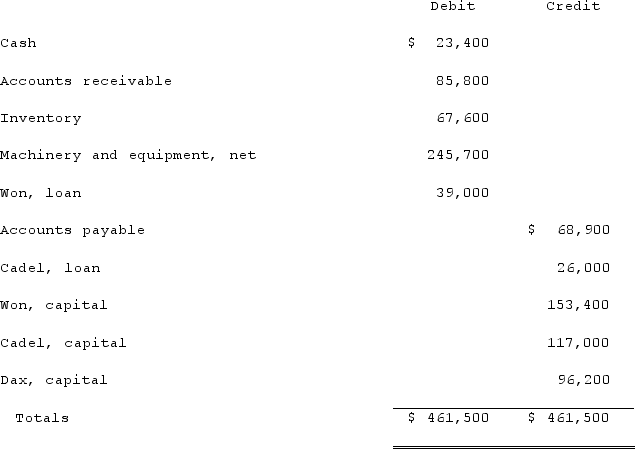

On January 1, 2021, the partners of Won, Cadel, and Dax (who shared profits and losses in the ratio of 5:3:2, respectively) decided to liquidate their partnership. The trial balance at this date was as follows:  The partners planned an installment program to dispose of the business assets and to minimize liquidation losses. All available cash, less an amount retained to provide for future expenses, was to be distributed to the partners at the end of each month. A summary of liquidation transactions follows:

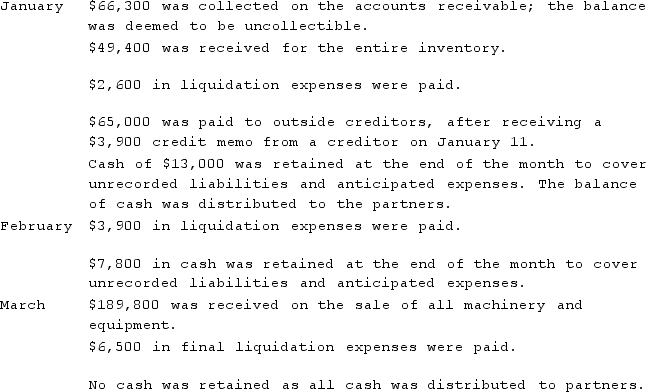

The partners planned an installment program to dispose of the business assets and to minimize liquidation losses. All available cash, less an amount retained to provide for future expenses, was to be distributed to the partners at the end of each month. A summary of liquidation transactions follows:  Prepare a schedule to calculate the safe payments to be made to the partners at the end of March.

Prepare a schedule to calculate the safe payments to be made to the partners at the end of March.

Definitions:

Lease-Purchase Analysis

A financial evaluation technique used to determine the most cost-effective option between leasing an asset and purchasing it outright.

Sale and Leaseback

A financial transaction where one sells an asset and leases it back for the long-term; thus, one continues to be able to use the asset but does not own it.

Balance Sheet

A financial statement that provides a snapshot of a company's financial condition at a specific point in time, detailing assets, liabilities, and equity.

Incremental Cash Flows

The additional cash flow generated by a company as a result of undertaking a new project or investment.

Q9: Which of the following is not a

Q18: The executor of the estate of Yelbert

Q26: Goodman, Pinkman, and White formed a partnership

Q28: White, Sands, and Luke has the following

Q31: State the two major types of legal

Q92: Certain balance sheet accounts of a foreign

Q93: In 2017, Hooverville consumed 205,000 tons of

Q151: Which of the following is an example

Q178: Normative analysis is concerned with "what ought

Q304: "The distribution of income should be determined