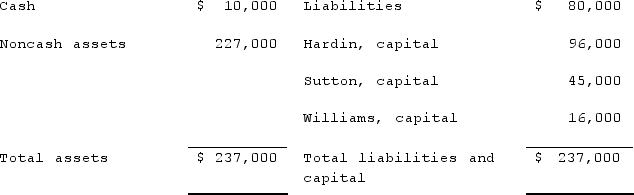

Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.The following balance sheet has been produced:  During the liquidation process, the following transactions take place:- Noncash assets are sold for $116,000.- Liquidation expenses of $12,000 are paid. No further expenses are expected.- Safe capital distributions are made to the partners.- Payment is made of all business liabilities.- Any deficit capital account balances are deemed to be uncollectible.Prepare journal entries to record the actual liquidation transactions.

During the liquidation process, the following transactions take place:- Noncash assets are sold for $116,000.- Liquidation expenses of $12,000 are paid. No further expenses are expected.- Safe capital distributions are made to the partners.- Payment is made of all business liabilities.- Any deficit capital account balances are deemed to be uncollectible.Prepare journal entries to record the actual liquidation transactions.

Definitions:

Excel File

A file format used by Microsoft Excel, typically with extensions such as .xls or .xlsx, for organizing and managing data in spreadsheets.

Refresh The Data

An action in software applications that updates or reloads the displayed data to ensure it represents the most current information available.

Sidebar

A vertical bar on the side of a user interface, often containing additional information, navigation options, or tools related to the main content.

Edit The Chart Data

The process of modifying the numerical or textual information that is represented in a chart, allowing for updated visualization of data.

Q6: The ABCD Partnership has the following balance

Q24: In governmental accounting, what term is used

Q26: A $6,000,000 bond is issued by Kensington

Q47: What is the basis of accounting used

Q50: What information is conveyed by the Statement

Q54: On a Statement of Activities for a

Q57: Lapin Corp. owned the following assets when

Q90: What exchange rate would be used to

Q134: Refer to Figure 1-3. Calculate the area

Q194: The prevalence of Alzheimer's dementia is very