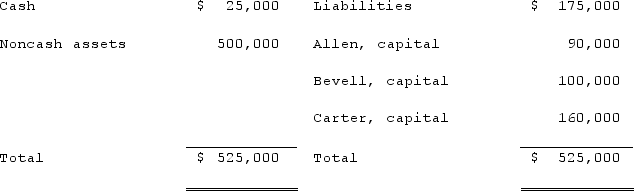

The Allen, Bevell, and Carter partnership began the process of liquidation with the following balance sheet:  Allen, Bevell, and Carter share profits and losses in a ratio of 3:2:5. Liquidation expenses are expected to be $14,000.Assuming that the noncash assets were sold for $150,000, which partner(s) would have been required to contribute assets to the partnership to cover a deficit in his or her capital account, prior to considering the liquidation expenses incurred?

Allen, Bevell, and Carter share profits and losses in a ratio of 3:2:5. Liquidation expenses are expected to be $14,000.Assuming that the noncash assets were sold for $150,000, which partner(s) would have been required to contribute assets to the partnership to cover a deficit in his or her capital account, prior to considering the liquidation expenses incurred?

Definitions:

Potency

The power or influence something possesses to affect changes or produce significant effects, often used in contexts ranging from medicine to leadership dynamics.

Meaningfulness

The quality of having significance, purpose, or value, giving a sense of fulfillment or importance.

Power

The capacity or ability to direct or influence the behavior of others or the course of events.

Team Empowerment

Team empowerment refers to the process or state in which team members are given authority, resources, and capability to make decisions and execute tasks independently, enhancing their effectiveness and motivation.

Q4: The types of differences that exist between

Q10: What accounting transactions are not recorded by

Q16: Which of the following is not one

Q38: Carpenter, Inc., a wholly owned subsidiary of

Q48: A city operates a swimming pool as

Q66: Esposito is an Italian subsidiary of a

Q66: Goodman, Pinkman, and White formed a partnership

Q68: The term "current financial resources" refers to<br>A)

Q143: Very few businesses, and virtually no nonprofit

Q181: Refer to Figure 1-6. Calculate the area