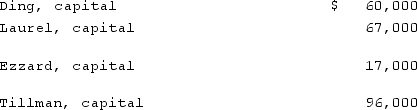

A local partnership was considering the possibility of liquidation. Capital account balances at that time were as follows. Profits and losses were divided on a 4:2:2:2 basis, respectively.  At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time.If the assets could be sold for $228,000 and there are no liquidation expenses, what is the amount that Laurel would receive from the liquidation?

At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time.If the assets could be sold for $228,000 and there are no liquidation expenses, what is the amount that Laurel would receive from the liquidation?

Definitions:

Voyeurism

A sexual interest or practice of gaining sexual pleasure from watching unsuspecting individuals who are naked, in the process of disrobing, or engaging in sexual activity.

College Students

Individuals enrolled in an institution of higher education, pursuing undergraduate or postgraduate studies.

Getting Undressed

Refers to the act of removing one's clothes, often associated with preparations for bathing, sleep, or sexual activity.

Zoophilia

A sexual interest characterized by an attraction to animals other than humans.

Q2: What was the purpose of the Securities

Q11: As of January 1, 2021, the partnership

Q13: The Amos, Billings, and Cleaver partnership had

Q24: Jell and Dell were partners with capital

Q29: Assume the partnership of Dean, Hardin, and

Q44: Filings with the SEC are divided generally

Q54: Assume the partnership of Howell, Madrid, and

Q67: Which of the following statements about economic

Q76: Goodman, Pinkman, and White formed a partnership

Q344: In economics, activities done for others, such