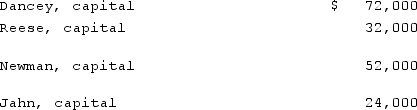

Dancey, Reese, Newman, and Jahn were partners who shared profits and losses on a 4:2:2:2 basis, respectively. They were beginning to liquidate their business. At the start of the process, Capital account balances were as follows:  Which one of the following statements is true for a predistribution plan?

Which one of the following statements is true for a predistribution plan?

Definitions:

Q6: The party to receive a distribution of

Q39: What are the four steps established by

Q43: "An increase in the price of gasoline

Q61: Which one of the following forms is

Q70: Assume there are no donor rights to

Q76: What is included in Part I of

Q168: On a two-dimensional graph, _ illustrate the

Q177: What is an entrepreneur, and what decisions

Q299: The U.S. Bureau of Labor Statistics forecasts

Q384: Define productive efficiency. Does productive efficiency imply