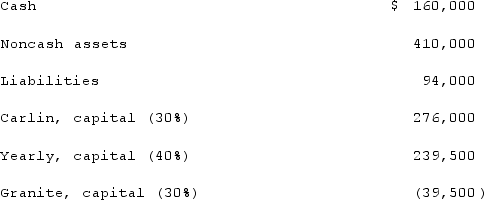

As of January 1, 2021, the partnership of Carlin, Yearly, and Granite had the following account balances and percentages for the sharing of profits and losses:  The partnership incurred losses in recent years and decided to liquidate. The liquidation expenses were expected to be $20,000.If the noncash assets are sold for $210,000, what would be the maximum amount of cash that Carlin could expect to receive?

The partnership incurred losses in recent years and decided to liquidate. The liquidation expenses were expected to be $20,000.If the noncash assets are sold for $210,000, what would be the maximum amount of cash that Carlin could expect to receive?

Definitions:

Required Return

The least percentage of profit or gain expected by an investor for taking the risk to invest in a specific asset or project.

Annual Dividend

The annual sum of dividends disbursed by a corporation to its stockholders.

Preferred Stock

A class of ownership in a corporation that has a higher claim on assets and earnings than common stock, usually with fixed dividends.

Par Value

The nominal or face value of a bond, share of stock, or other financial instrument, as stated by the issuer.

Q8: Describe the two parts of the SEC

Q15: Which of the following describes proprietary funds?<br>A)

Q36: The provisions of a will currently undergoing

Q45: The Town of Sitka opened a solid

Q67: Clark Co., a U.S. corporation, sold inventory

Q68: The term "current financial resources" refers to<br>A)

Q80: A local partnership has two partners, Jim

Q82: Clark Stone purchases raw material from its

Q87: Candice Company is currently going through bankruptcy

Q282: Refer to Table 1-8. The table above