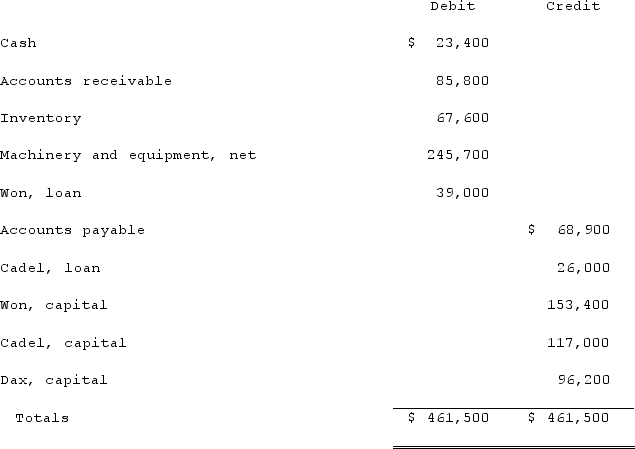

On January 1, 2021, the partners of Won, Cadel, and Dax (who shared profits and losses in the ratio of 5:3:2, respectively) decided to liquidate their partnership. The trial balance at this date was as follows:  The partners planned an installment program to dispose of the business assets and to minimize liquidation losses. All available cash, less an amount retained to provide for future expenses, was to be distributed to the partners at the end of each month. A summary of liquidation transactions follows:

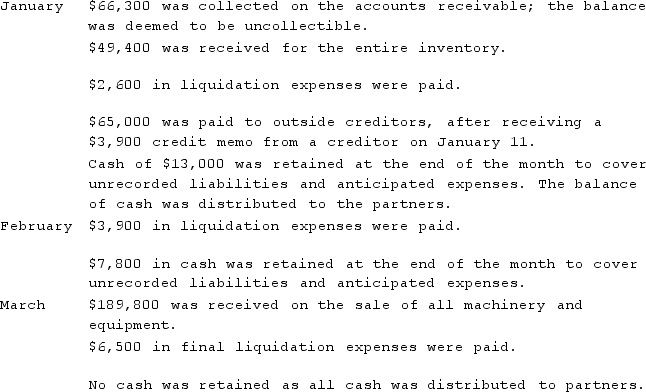

The partners planned an installment program to dispose of the business assets and to minimize liquidation losses. All available cash, less an amount retained to provide for future expenses, was to be distributed to the partners at the end of each month. A summary of liquidation transactions follows:  Prepare a schedule to calculate the safe installment payments to be made to the partners at the end of February.

Prepare a schedule to calculate the safe installment payments to be made to the partners at the end of February.

Definitions:

Surface Traits

Observable qualities or characteristics of an individual's personality that can easily be inferred from behavior, as opposed to deeper, less observable traits.

Personality Characteristics

Traits that describe an individual's consistent patterns of thought, feeling, and behavior.

Dynamic Traits

Traits that describe our motivations and interests.

Temperament

Innate aspects of an individual's personality, such as sensitivity, mood, activity level, and emotional reactivity.

Q10: IFRS 1 requires companies transitioning to IFRS

Q27: Donald, Anne, and Todd have the following

Q54: On a Statement of Activities for a

Q56: Certain balance sheet accounts of a foreign

Q57: Which group of financial statements is prepared

Q73: Lucky Co. had cash of $65,000, inventory

Q76: Under the current rate method, depreciation expense

Q81: Cash would be included in which section

Q88: The forward rate may be defined as<br>A)

Q412: Refer to Figure 1-4. Which of the