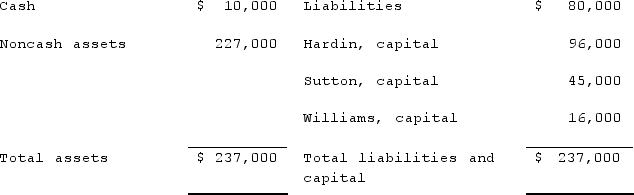

Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.The following balance sheet has been produced:  During the liquidation process, the following transactions take place:- Noncash assets are sold for $116,000.- Liquidation expenses of $12,000 are paid. No further expenses are expected.- Safe capital distributions are made to the partners.- Payment is made of all business liabilities.- Any deficit capital account balances are deemed to be uncollectible.Prepare journal entries to record the actual liquidation transactions.

During the liquidation process, the following transactions take place:- Noncash assets are sold for $116,000.- Liquidation expenses of $12,000 are paid. No further expenses are expected.- Safe capital distributions are made to the partners.- Payment is made of all business liabilities.- Any deficit capital account balances are deemed to be uncollectible.Prepare journal entries to record the actual liquidation transactions.

Definitions:

Hypothesized Probability Distribution

A specified probability distribution based upon assumptions or theories, prior to analyzing data.

Chi-Square Tests

A statistical test used to determine the significant difference between observed and expected frequencies in one or more categories.

Equality

The state or quality of being identical, equal, or equivalent in value, measure, significance, etc.

Degrees of Freedom

The number of independent values or quantities that can be assigned to a statistical distribution, minus the number of parameters estimated.

Q9: Which type of account would you assign

Q17: What is the significance of the "Norwalk

Q37: What assets would be included in the

Q41: "Stockholders" equity would be included in which

Q46: Which of the following is not a

Q51: The parking garage and parking lots owned

Q65: Donald, Anne, and Todd have the following

Q88: The forward rate may be defined as<br>A)

Q250: Which of the following is a positive

Q426: Refer to Figure 1-4. Which of the