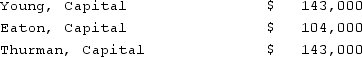

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Eaton's total share of net loss for the first year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Eaton's total share of net loss for the first year?

Definitions:

Streak

A long, thin line or mark of a different substance or color from its surroundings.

Cleavage

A property of minerals that allows them to break along smooth, flat surfaces based on their crystal structure.

Cleavage

A property of minerals that describes how they break along certain planes where their atomic bonding is weaker, resulting in smooth, flat surfaces.

Liquid State

A phase of matter characterized by a definite volume but no definite shape, allowing it to flow and take the shape of its container.

Q3: Under the current rate method, how would

Q9: In settling an estate, what is the

Q29: A local partnership has assets of cash

Q29: Assume the partnership of Dean, Hardin, and

Q36: Jackson Corp. (a U.S.-based company) sold parts

Q38: In settling an estate, what is the

Q54: Under the temporal method, common stock would

Q70: The terms of a will currently undergoing

Q219: What is a firm? What other terms

Q277: _ have a horizontal and a vertical